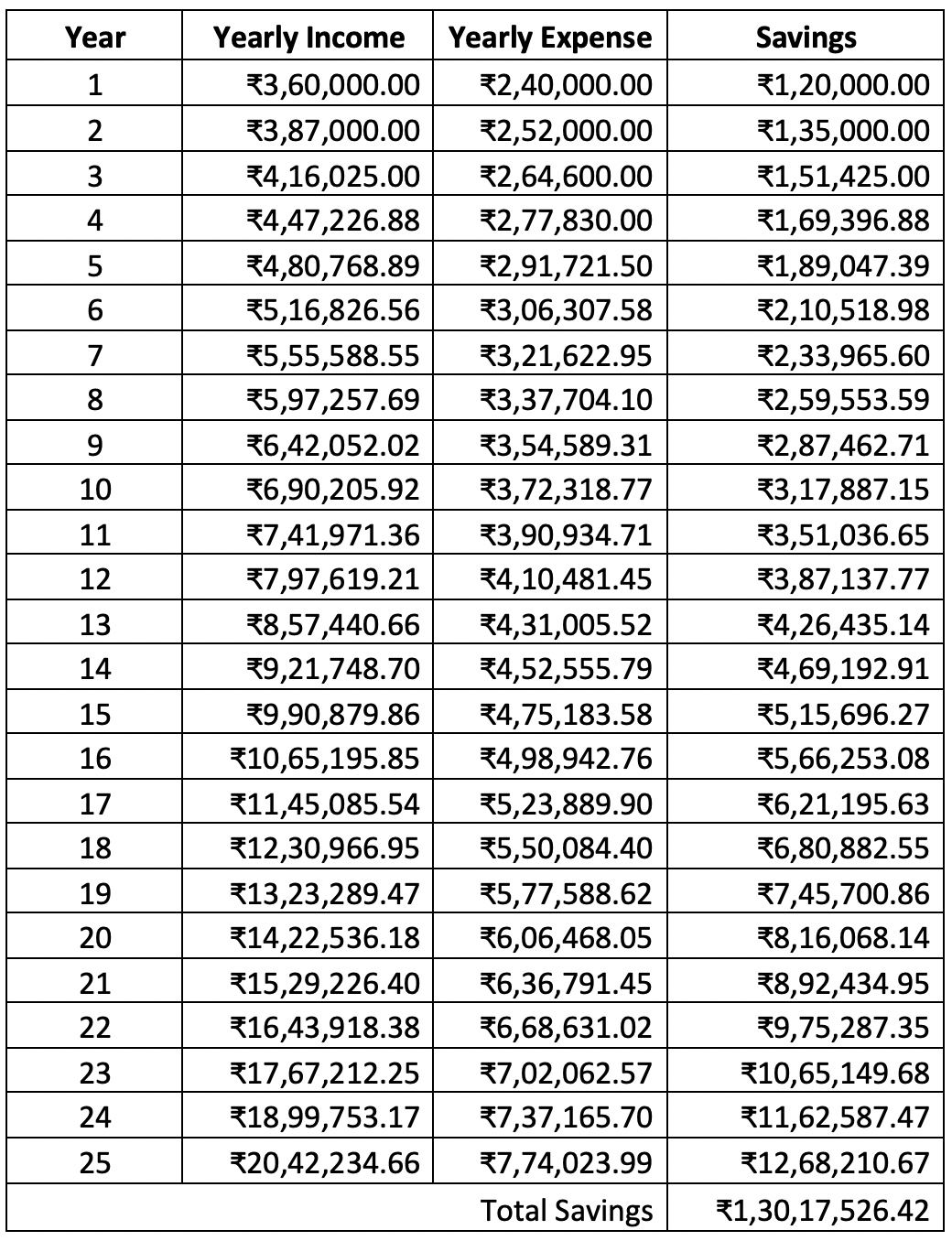

To start with let’s consider the life of Mr. Shyam (fictitious character) who is 25 years old. Shyam has graduated recently and joined a Multinational IT firm. Now he started his career with a package of 3.6 LPA (the usual salary to start with, in a service-based organization). So, he gets approximately ₹30,000 per month, without considering any deduction. Now he spends ₹12,000 on house rent, food, and transport. Another ₹8,000 on leisure, shopping, medical expenses, etc. Now, he has surplus ₹10,000 which is retained in a savings account. Now for simplicity let’s consider, that he gets a fixed hike of 7.5% every year and his expenses to rise by 5% year on year. Let us also consider Shyam plans to retire at the age of 50. So, at the time of retirement, he has a savings of ₹1.3Cr (refer to the chart).

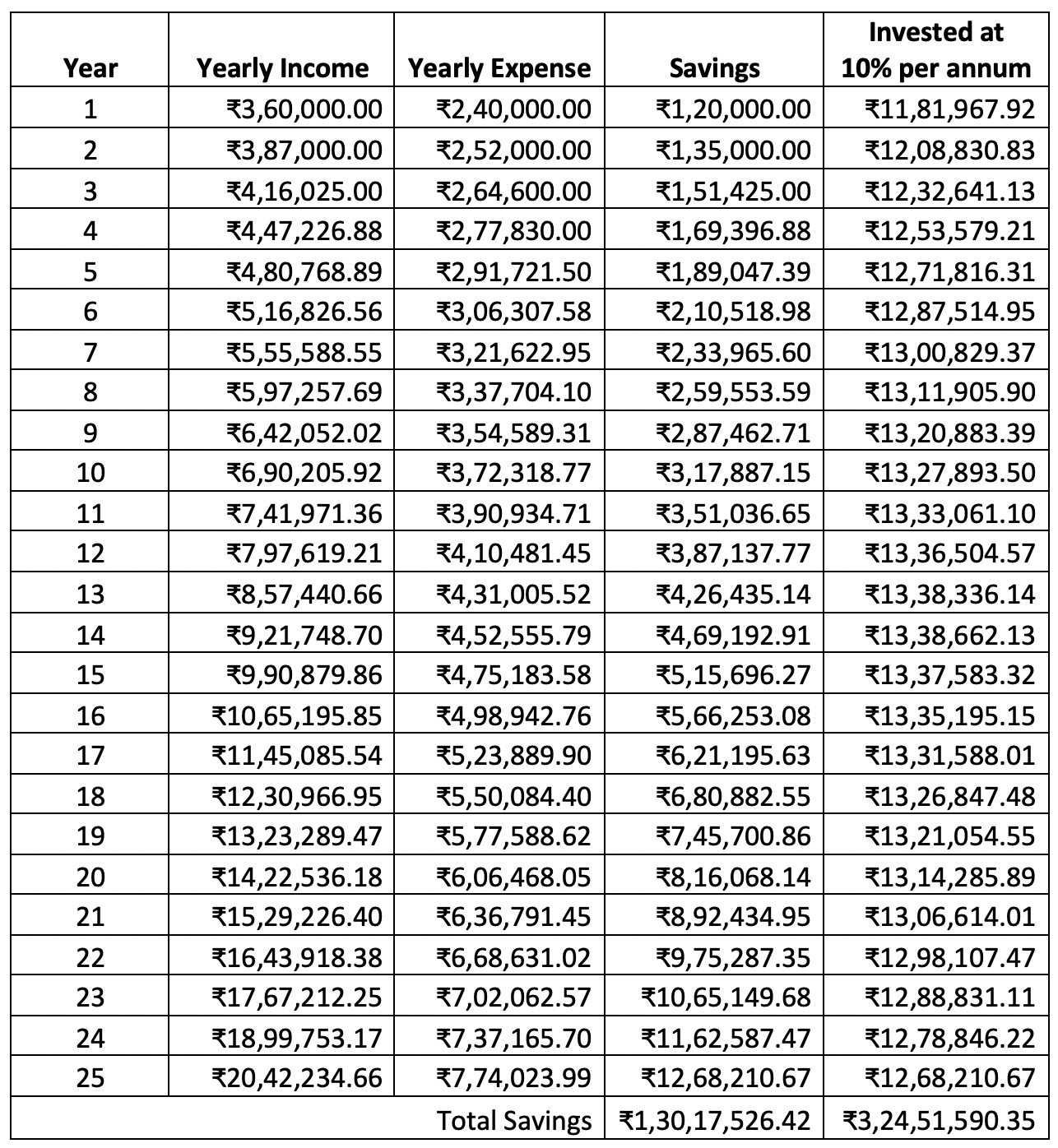

After 25 years of hard work, Shyam managed to accumulate ₹1.3Crs. Now after retirement, if he wants to maintain the same lifestyle and his expenses rise by the same 5%, with the fund he has, it will last only for the next 12 years. So he can survive independently till the age of 62. Now, let’s consider Shyam decides to invest that amount in different funds where he can earn a return of 10% compounded annually.

We can clearly see, that he can save three times more than he did earlier. This will definitely help him sustain his post-retirement life. Investing at an early age leads to a compounding of returns. Regular investments from a young age can reap a huge benefit at the time of retirement. The money will grow with time. And if it is not invested properly you might have a tendency of spending that amount. Also, this will eventually make you responsible while spending. This way, you can afford many things which others might not be able to afford at that age. You will be able to beat the inflation, fulfill your needs, marriage, children’s education, purchase of property, and plan your retirement vacation!